What’s been cranking in the world of business in the early stages of 2024? We rounded up the top business news for the month of January. Let’s dive in…

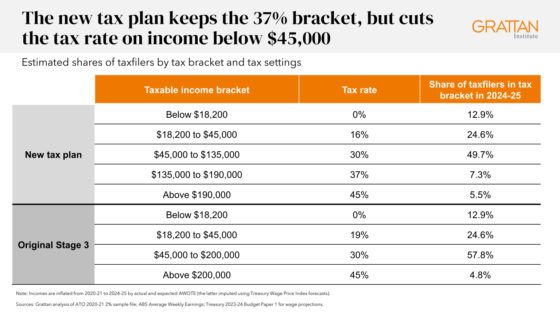

Revised Stage 3 tax cuts to benefit the overwhelming majority of Australians.

Almost every Australian will be receiving a tax break in the upcoming stage three tax cuts. In fact, on average Australians will see an $804 benefit.

While some at the top end of town may receive less than the generous slash promised by the previous government, the revised stage 3 tax cuts will now contain meaningful benefit to the majority of Australians.

Why were the stage three cuts altered to reduce additional benefits for the highest earners in Australia and passed onto lower and middle income earners?

Prime Minister Albanese noted that the adjustments were based on treasury advice that the legislated cuts no longer made sense in a high-inflation environment. The Prime minister stated to the press club that,

“Some would say that we should stay the course, even if it means going to the wrong destination,”

“To them I say, we are choosing a better way forward given the changed circumstances. We are doing the right thing, for the right reasons.”

These alterations mean that low and middle income earners will now receive much more significant benefits, with many citing that around 85-90 percent of Australians would be better off.

As ANU economist Ben Phillips stated,

“Under the Coalition, really, the higher you went up the income scale, the higher the percentage savings … It’s a package very much tilted in favour of high-income earners.

“It’s true that Labor’s plan still probably tilts things towards more high-income individuals. But it still means that about 90 per cent of people who pay tax will be better off [than under the original plan].”

Let’s take a quick overview.

Image source: Grattan Institute.

Australian businesses may start discounting to maintain market share

There are strong signs that Australian businesses may start discounting goods to maintain customers amid a levelling out of inflation and an easing of pandemic induced supply issues.

A large NAB survey of roughly 1000 businesses, from a range of industries across the nation, suggests Australian businesses are becoming worried enough about losing customers that shoppers can soon expect to be paying less at the register.

When the pandemic affected supply chains and costs soared, businesses would generally pass these cost on to their customers. This in turn fuelled inflation. As a result, households are now looking for bargains and businesses may have to meet those demands or see customers dry up.

NAB’s chief economist Alan Oyster says the survey results point to a business sector worried about short term survival and maintaining a customer base and are less concerned with boosting profits.

“It’s telling me business is basically worried about the short-term outlook,” Mr Oster said.

The ‘new’ RBA meets. What will happen with inflation and interest rates?

With Michelle Bullock now firmly at the helm of the RBA, what have we seen in the beginning of the year as far as inflation and projected interest rates?

With their first 2024 meeting in the bag with no rate rise, many economists are tipping that rates will continue to hold, but that we’ll see possible rate cuts later in the year. There are, of course, no promises.

With inflation falling, it’s a matter of time before borrowers receive a reprieve.

Investment firm Deutsche Bank said a 0.25 percentage point rate cut in May was “a material possibility”.

Mr. Oster id of the opinion that,

“the Reserve Bank will want to see where the labour market is — they will want to see what the impact of tax cuts are,” he said.

“I personally don’t think they’ll have any impact, but they will want to see.

“So I think it’s more likely that you’re going to have [interest] rate cuts but not starting until the end of the year, so we’ve got them temporarily in November.”

Economist Rae Dufty-Jones agreed with those predictions.

“Inflation is certainly slowing,” she said.

“There are a few things that remain to be seen in terms of the impact of the price of energy, which is a major contributor to the cost of business, and of course the implications for the changes to the stage 3 tax cuts and what that might mean for inflation as well.”

We’ll have to wait and see what happens with Bullock’s ‘reformed’ RBA in the next few months.

Leave a Reply