Here at Reckon, our primary concern is the wellbeing and prosperity of Australian small and medium businesses. So, with the Federal Budget looming, we wanted to understand what they were really looking for. What measures are important to small businesses?

We conducted a study to get to the bottom of what businesses want to see on 14 May 2024 when the Federal Budget drops. Here’s what we found…

What are the top priorities for business owners?

What measures matter most to small businesses in the upcoming budget?

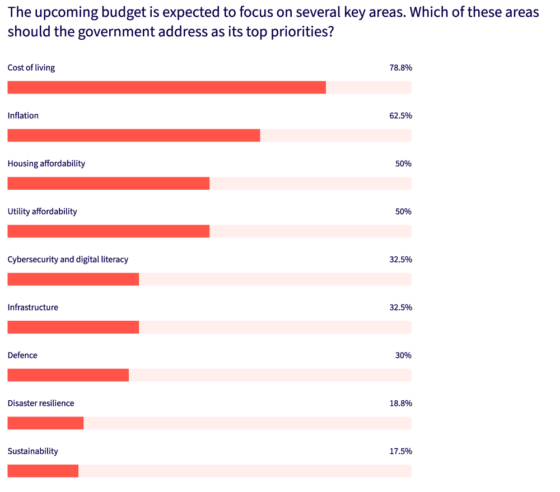

What we found was relatively unsurprising, with cost of living (78%), inflation (60%), and housing affordability (51%) topping the list.

On the lower end of the scale, businesses were less concerned with defence (29%), disaster resilience (19%), and sustainability (18%)

Reckon CEO Sam Allert says it’s not surprising that cost of living and inflationary pressures are at the forefront of business concerns.

“We’re currently witnessing stark and palpable pressures on businesses that we haven’t seen for many years,” Allert explains.

“Higher costs of living represent a double-edged sword, where business owners are not only paying more for goods and services but are also pressed to pass these costs on to consumers, who are also tightening their belts.”

“This concern was laid bare by the data we collected, with 85% of small businesses looking for measures to address inflationary pressure.”

“Those with mortgages and loans are also being hit with higher interest rates, creating more financial stress. These businesses will be looking for various forms of relief in the upcoming federal budget,” says Allert.

What kinds of tax and stimulus measures are businesses hoping to see?

High on the agenda of small businesses are favourable tax cuts and other stimulus measures that will give them a boost, especially when tax time comes around.

With the newly revised stage three tax cuts announced by the Treasurer earlier this year, it seems that most business owners surveyed by Reckon do not believe there is any additional benefit to them.

This is despite the fact that the vast majority of taxpayers, particularly low and middle income earners, will actually be better off under the revised tax cuts.

Our survey found that 46% believed they wouldn’t be better off, while only 11% agreed they would be better off – the remaining 35% weren’t sure.

This lack of surety could indicate that many business owners are not aware of the details of the revised stage three tax cuts and whether they will see a benefit or not. Or perhaps they largely sit in higher income brackets.

What other tax and stimulus measures were important (or not so important) for SMEs?

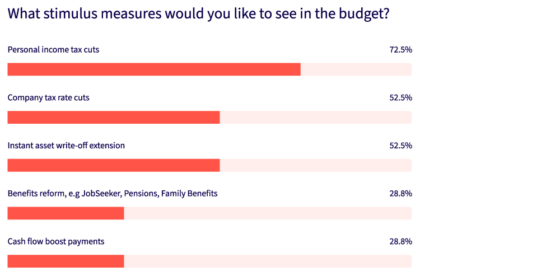

Although there’s reticence around the impending stage three tax changes, personal income tax cuts (74%) still topped the wish list, closely followed by company tax cuts (55%).

In contrast, benefits reform (29%) and cash flow boost payments (29%) were on the lower end of the scale.

What kinds of pressures are businesses currently facing?

To paint a broader picture of the mood of small businesses right now, we asked a few questions about specific pain points they’re currently facing.

Rent hikes have received a lot of attention lately, so we asked whether the respondents had recently faced a rental increase. We found that almost a third (30%) had indeed received a rent increase in the last year, while the majority (70%) had not.

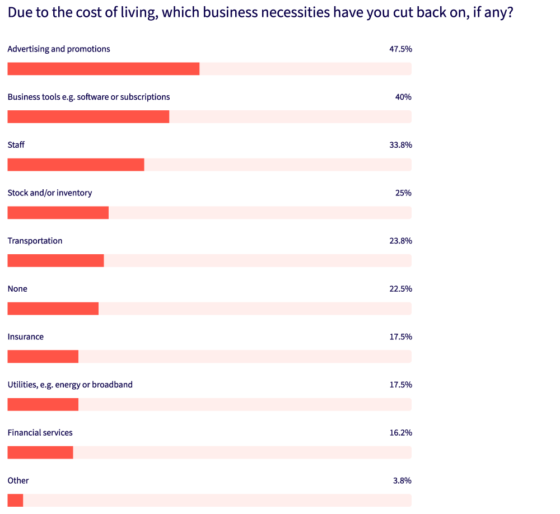

With the cost of living soaring, we also wanted to discover what kinds of expenses businesses were cutting back on. We found that advertising and promotion (47%) were the first items to go, while necessities like utilities (18%) and insurance (18%) among the last to fall.

Interestingly, financial services (16%) were the last to get cut: perhaps financial advice is seen as indispensable right now.

Cybersecurity represents a significant concern for businesses

Cybersecurity threats are on the rise. There’s been an increase in the prevalence and sophistication of scams and phishing attacks, and this will only worsen with the prevalence of AI.

As Reckon CTO Ed Blackman tells us,

“What we see now are more sophisticated and targeted attacks than in the past. Criminals are getting smarter, phishing scams are more researched and realistic, and it’s no longer the poorly worded ‘Nigerian prince’ emails you need to worry about. Through social engineering and highly targeted scams, there is much more risk nowadays of getting tricked.”

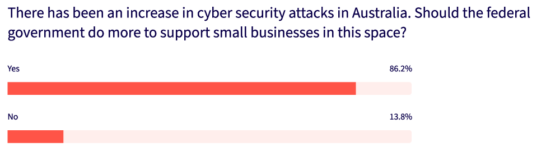

While ‘cybersecurity and digital literacy’ didn’t rank too highly in the budget priority list (33%), we found that there was reasonably high concern (86%) when we asked small businesses directly.

The federal government is already enacting several measures and campaigns to raise awareness of cybersecurity risks and enhance digital literacy, but it’s clear there’s hunger for more action in this space.

How do small businesses feel about renewable energy, sustainability, and climate change?

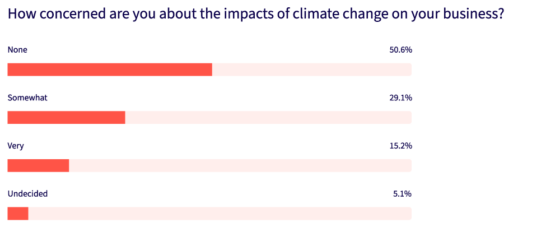

Across a range of data points, small businesses in Australia seem largely unconcerned, or reasonably ambivalent, about the impacts of climate change on their business.

Despite the existential and economic risks of environmental inaction, our study found that there was a significant lack of urgency or concern.

When asked about which measures they would like to see the government focus on in this year’s budget (such as cost of living and inflation), ‘sustainability’ ranked the lowest at an anemic 18%.

When we enquired about their concern level regarding the impacts of climate change on their business, the response was rather clear, with 51% displaying ‘no concern’ and only 15% ‘very concerned’.

We also asked our respondents whether the Prime Minister’s hints at renewable energy rebates would be ‘good for their business’.

We found that the split was reasonably modest, with 38% saying no, 38% unsure, and only 24% answering in the affirmative.

So, there we have it: this is the current mood among small businesses ahead of 14 May 2024. Stay tuned for a full business focused debrief when the 2024/2025 Federal Budget finally drops.

Leave a Reply